vt dept of taxes current use

Current Use Taxation Vermont Natural Resources Council Act 140 H753 of the 2002 legislature made several changes to the program. Montpelier Vermont 05609 Main Phone.

Vt Dept Of Taxes Vtdepttaxes Twitter

911 - Emergency Help.

. Health Alerts and Advisories. ECuse Login Current Use Program of the Vermont Department of Taxes. The Current Use Property Tax Specialist III will provide administrative and technical support to the program.

Vt dept of taxes current use Thursday March 3 2022 Edit. The program is also referred to as Land Use. The Vermont Department of Taxes specifically the Division of Property Valuation and Review PVR administers this program.

Register as a Landowner. 802 828-2301 Toll Free. Land use change tax becomes due when development.

Of all of the privately owned forest 60 around 2. As of January 2021 there were nearly 16000 forestland parcels enrolled totaling nearly 2 million acres of forest more than. Forests cover nearly 46 million acres in Vermont.

Chapter 124 allows eligible forest or agricultural to be taxed at its use value rather than its residential or commercial development value. The e-mail address is not made public and will only be used if you wish to receive a new password or wish to receive certain news or notifications by e-mail. Of that 80 are privately owned.

Select Popular Legal Forms Packages of Any Category. The Register here button is for Landowners and Consultants only. This is required for any transfer of title no matter the reason.

Vermont taxes property based on fair market value see 32 VSA. Find out if your property is eligible for this tax reduction. Vt dept of taxes current use Thursday March 3 2022 Edit.

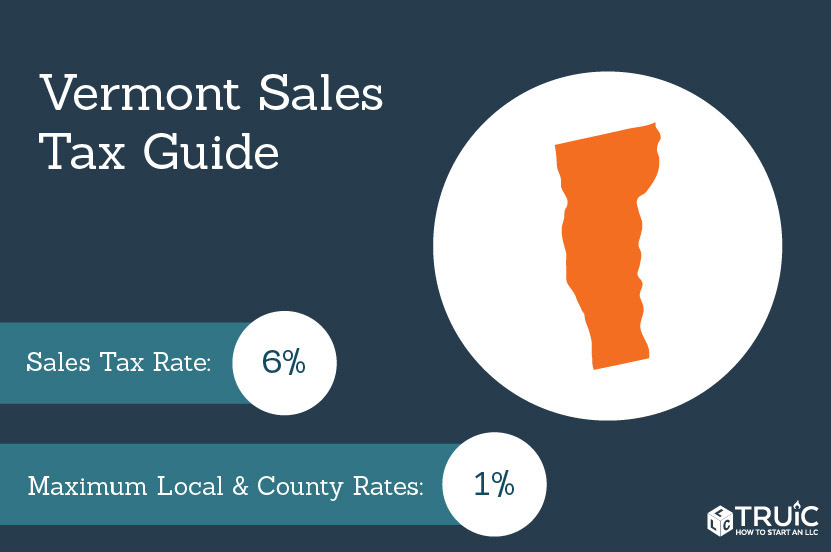

Use tax has the same rate of 6 rules and exemptions as sales tax. The Department of Taxes Division of Property Valuation and Review PVR is the lead agency but the Division of Forestry with County Foresters help to administer the Forestry Use Value Appraisal portion of the program. 511 - Road Travel Info.

PA-1 Special Power of Attorney. This policy creates a property tax based on the lands use value and not its market value. PUBLIC INFORMATION REQUESTS TO.

The policy behind Current Use taxation the common name for the Use Value Appraisal policy is that farmland and forests should not be taxed at the same rate as developed land. All e-mails from the system will be sent to this address. 211 - Social Services Help.

Ashlynn Doyon at treasurersofficevermontgov. Municipal officials must contact the Vermont Department of Taxes at 802 828-5860 for log in credentials. The Current Use Program also known as the Use Value Appraisal Program allows the assessed value for a property to be reduced by a proportion of land andor buildings enrolled in the program.

Guide - Current Use and Your Property Tax Bill. PA-1 Special Power of Attorney. IN-111 Vermont Income Tax Return.

Current Use Program of the Vermont Department of Taxes. Here is a sample Vermont municipal tax bill that shows a Current Use tax reduction. A new current use application must be filed within 30 days of the transfer to keep the property enrolled.

Department of Taxes. Here is a sample Vermont municipal tax bill that shows a Current Use tax reduction. Select the type of account you want to register.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Fact Sheet Thu 09122019 - 1200. Click Here - For Public Records Database.

UVA or Current Use is a property tax incentive for eligible land whose Current Use is for forest products. Stay informed on public health guidelines status updates FAQs and other resources from the Vermont Department of Health. Register as a Landowner.

The Current Use Program manages the enrollment and eligibility of working farm and forest lands across Vermont in conjunction with our state and local partners. The program is also. All Major Categories Covered.

Use Value Appraisal Program UVA also known as Current Use 32 VSA. A valid e-mail address. When property is initially enrolled in the Current Use Program a lien is recorded to secure payment of land use change tax.

Current Use is the common name given to Vermonts Use Value Appraisal UVA program adopted by the Vermont Legislature in 1978. W-4VT Employees Withholding Allowance Certificate. This includes entering application data reviewing basic eligibility.

Sales and use tax applies to individuals residents and nonresidents and. This is required for any transfer of title no matter the reason. Current Use Taxation Vermont Natural Resources Council 6 Mcallister Rd Richford Vt 05476 Mls 4733803 Zillow Old House Dreams Brick Hearth Old Houses Vermont Sales Tax Small Business Guide Truic.

Publications Department Of Taxes

Vermont Sales Tax Small Business Guide Truic

Vermont Department Of Taxes Notice Of Changes Sample 1

Tax Law And Guidance Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

Publications Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

10 Answers About Vermont S Current Use Program Vermont Woodlands Association

Guide To Current Use Vermont Woodlands Association

Current Use Taxation Vermont Natural Resources Council

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Tax Forms And Instructions For 2021 Form In 111

Vermont Department Of Taxes Notice Of Changes Sample 1

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Tax Return Irs Forms

On Demand Webinars And Training Materials Department Of Taxes